How to Use Moving Averages to Spot Market Trends

Jeffery ObiagwuShare

Introduction to Moving Averages

What Is a Moving Average?

A moving average (MA) is a tool used by traders to smooth out price data. It averages past prices over a specific time period and plots a line on the chart, helping identify the direction of a trend.

Why Moving Averages Matter

They:

-

Simplify market noise

-

Show trend direction

-

Provide support/resistance

-

Signal potential trade opportunities

Types of Moving Averages

Simple Moving Average (SMA)

-

Averages prices over a chosen period equally

-

Common for long-term analysis (e.g., 50 SMA, 200 SMA)

Exponential Moving Average (EMA)

-

Gives more weight to recent prices

-

Reacts faster to price changes (e.g., 9 EMA, 21 EMA)

Weighted Moving Average (WMA)

-

Heavily emphasizes recent prices

-

Less commonly used, but useful for short-term traders

Best Moving Average Settings by Timeframe

| Timeframe | Recommended MAs |

|---|---|

| Day Trading | 5 EMA, 9 EMA, 20 EMA |

| Swing Trading | 20 EMA, 50 SMA |

| Long-Term Investing | 100 SMA, 200 SMA |

Choose your MA based on how fast you want it to respond to price changes.

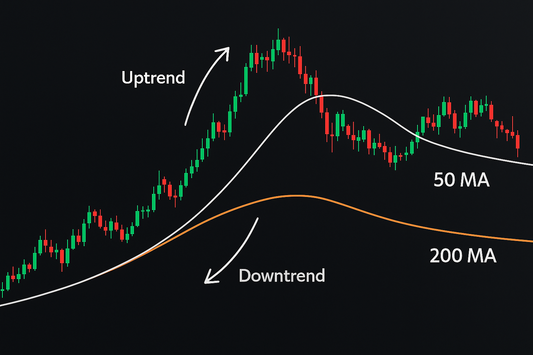

How to Identify Trend Direction with MAs

Bullish and Bearish Crossovers

-

Golden Cross: 50 SMA crosses above 200 SMA – bullish signal

-

Death Cross: 50 SMA crosses below 200 SMA – bearish signal

Slope and Angle of the MA

-

Rising MA = uptrend

-

Falling MA = downtrend

Price vs. MA Positioning

-

Price above MA = bullish bias

-

Price below MA = bearish bias

Popular Moving Average Strategies

Golden Cross and Death Cross

Used mostly on daily charts for major trend shifts.

Moving Average Crossover Strategy

-

Entry when fast MA crosses slow MA

-

Add volume or candlestick confirmation

Price Bounce Off Moving Average

Use MAs as dynamic support/resistance during pullbacks in a trend.

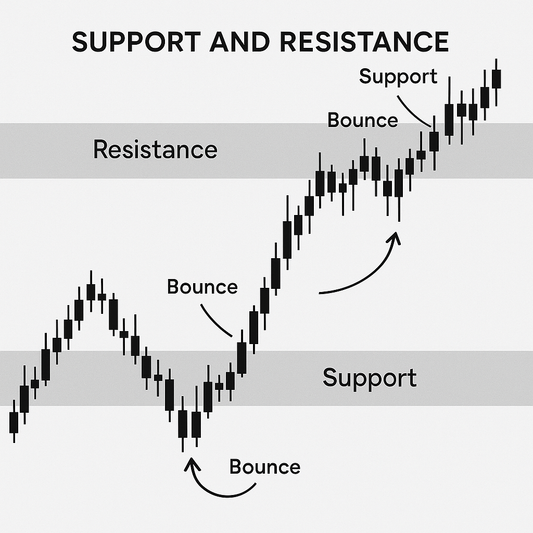

Support and Resistance with Moving Averages

Dynamic Support/Resistance

-

Price bounces off MA in trending markets

-

Strong levels: 20 EMA for short-term, 200 SMA for long-term

Moving Averages in Trend Continuation

-

Pullback to MA = entry opportunity

-

Strong trend resumes after touch

Combining Multiple MAs for Confirmation

Dual MA Strategy

-

Use one fast and one slow MA

-

Entry on cross, exit when they reverse

Triple MA Ribbon Setup

-

3 MAs: short, medium, long

-

Shows trend strength and confirmation

Using Moving Averages with Other Tools

MAs + RSI

-

Confirm trend with MAs

-

Use RSI for overbought/oversold signals

MAs + Volume

-

Volume confirms strength of move when price touches MA

MAs + Candlestick Patterns

-

Enter after price bounces off MA with bullish or bearish candles

Common Mistakes in MA Usage

-

Relying Solely on MAs: Use with price action

-

Using the Wrong Settings: Overfitting to historical data

-

Ignoring Market Context: MAs lag—don't trade them blindly

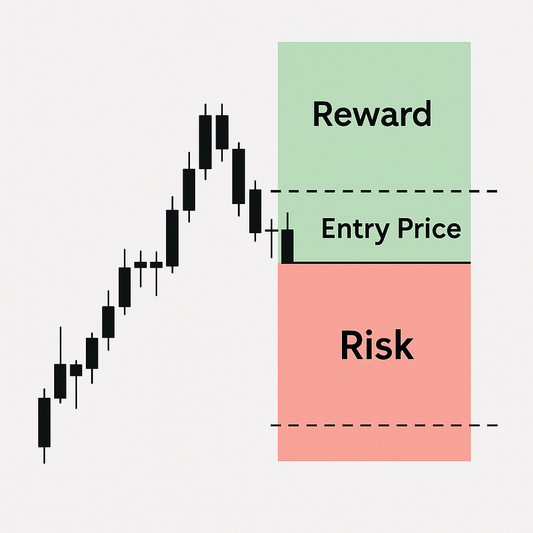

Backtesting and Optimizing MA Strategies

-

Test MAs on historical charts

-

Measure win rate, risk-reward, drawdowns

-

Adjust based on asset volatility

Using Moving Averages in Forex, Stocks, and Crypto

Forex

-

Fast-moving, responsive MAs work well (e.g., 9 EMA, 21 EMA)

Stocks

-

SMA 50 and 200 are widely watched for breakouts and breakdowns

Crypto

-

Trend-heavy; use MAs with strong slope and longer periods

FAQs About Moving Averages

1. What’s the best moving average?

It depends on your trading style. EMA for fast moves, SMA for steady trends.

2. Do MAs work in all markets?

Yes, but effectiveness varies with volatility and liquidity.

3. Are they lagging or leading indicators?

MAs are lagging indicators—they react after price moves.

Conclusion and Trader’s Tips

Moving averages are a staple for trend detection. Whether you’re a day trader or long-term investor, using MAs with proper context will help you filter out noise and stay on the right side of the market. Start simple, test your strategy, and trust the trend.

📘 Train Your Trading Mind with “The Trader’s Reflection”

Indicators guide your entries—but your mindset determines your success. The Trader’s Reflection is your secret weapon for staying focused, disciplined, and emotionally strong in every trend and trade.

➡️ Get your copy of The Trader’s Reflection now and let your mental edge catch every moving average setup.