Understanding Risk-Reward Ratio: How to Protect Capital and Maximize Gains

Jeffery ObiagwuShare

Introduction to Risk-Reward Ratio (RRR)

Why RRR Is Crucial to Trading Success

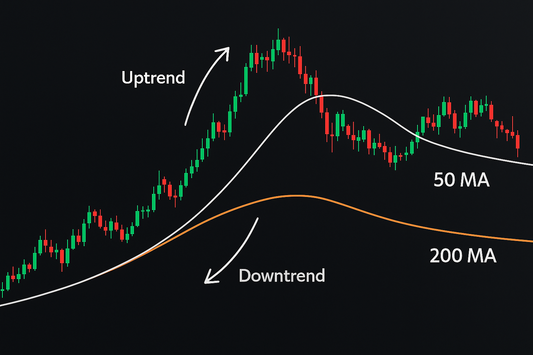

Most traders focus on winning, but professional traders focus on how much they risk to win. The risk-reward ratio (RRR) tells you if a trade is worth taking. It shows how much potential profit you gain for every dollar you risk.

What the Ratio Tells You

-

A 2:1 ratio means you’re risking $1 to potentially make $2.

-

Higher RRR = fewer wins needed to be profitable.

-

It’s a cornerstone of successful trading.

How to Calculate Risk-Reward Ratio

Basic Formula

(Target – Entry Price) / (Entry Price – Stop Loss)

Example

-

Entry: $100

-

Stop-Loss: $95

-

Target: $110

(110 - 100) / (100 - 95) = 10 / 5 = 2:1

You're risking $5 to potentially make $10.

Ideal Risk-Reward Ratios for Different Strategies

| Strategy Type | Ideal RRR |

|---|---|

| Scalping | 1:1 – 1.5:1 |

| Swing Trading | 2:1 – 3:1 |

| Position Trading | 3:1 or more |

Choose the RRR that matches your trade duration and volatility tolerance.

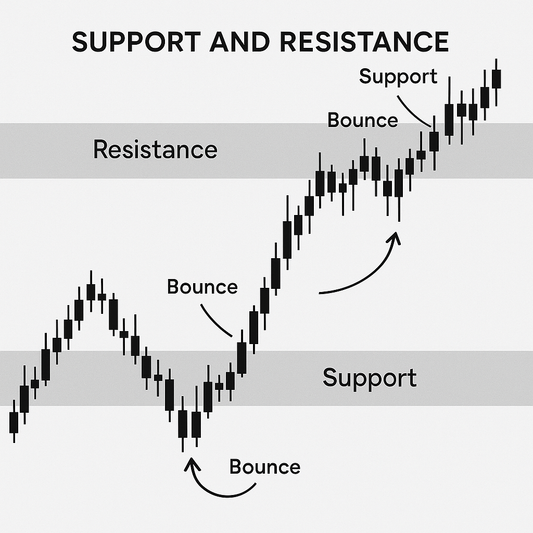

How to Set Stops and Targets Properly

Using Technical Levels

-

Place stop-loss below support (for longs)

-

Set target at next resistance

Volatility-Based Stops

Use ATR (Average True Range) to account for market noise.

Price Structure

-

Target previous swing highs/lows

-

Place stop where structure breaks

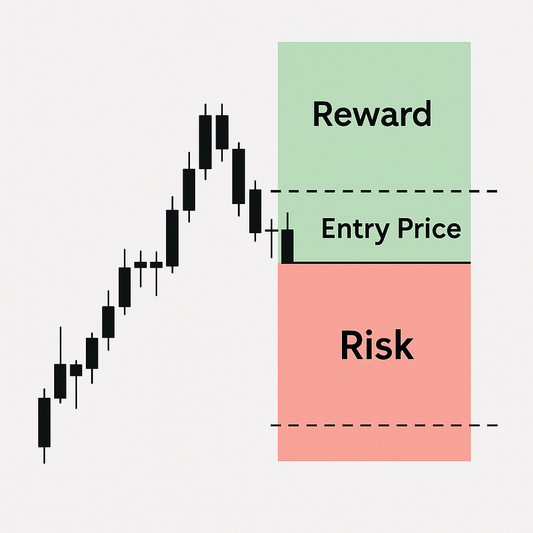

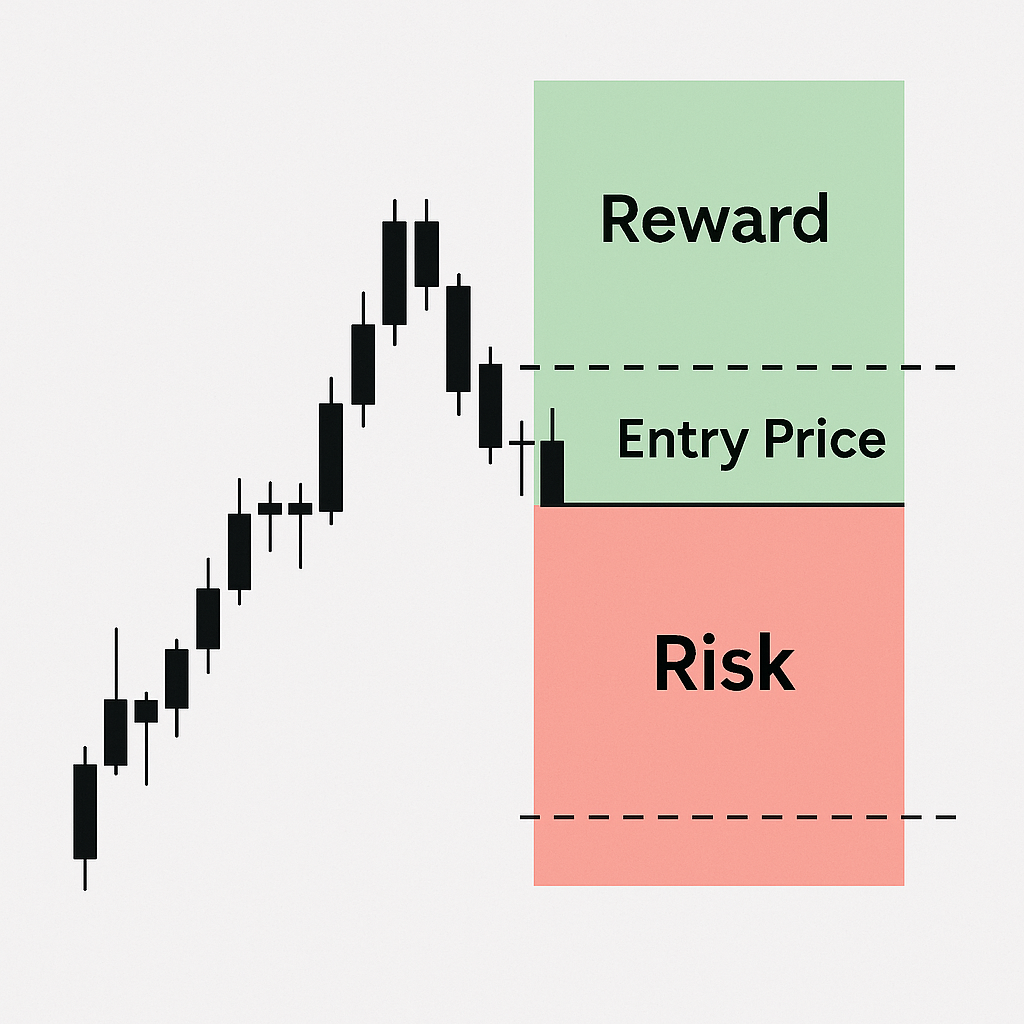

Visualizing Risk-Reward on a Chart

-

Risk boxes: Show stop distance

-

Reward zones: Show potential profit area

-

Platforms like TradingView let you plot this visually

Seeing it on the chart helps you filter out bad setups.

Why High Win Rate Isn’t Enough Without RRR

Losing System with High Accuracy

Even with a 70% win rate, if your losses are double your gains, you'll eventually lose money.

Winning System with Modest Accuracy

A trader with 40% win rate and 3:1 RRR can still be highly profitable. Why? Big wins cover small losses.

Improving RRR Through Better Entries

-

Wait for price to reach support/resistance before entering

-

Use tight stops with strong confirmation

-

Avoid chasing breakouts—enter on pullbacks

RRR in Backtesting and Trade Journals

-

Track every trade’s RRR

-

Analyze average RRR over time

-

Adjust your setup to improve the ratio without forcing trades

Psychology of Accepting Small Losses

Detaching Emotion from Losing Trades

Losing is part of the game. What matters is that your wins are bigger than your losses.

Reframing Losses

Think of losses as business expenses, not failures.

Combining RRR with Win Rate for Consistency

| RRR | Required Win Rate for Break-Even |

|---|---|

| 1:1 | 50% |

| 2:1 | 33% |

| 3:1 | 25% |

Low win rate? Boost your RRR. High win rate? Focus on efficiency.

Common Mistakes with Risk-Reward

-

Chasing trades without proper RRR

-

Moving stops emotionally

-

Ignoring the trade plan in hopes of more profits

Stick to the plan. Every tweak affects your long-term profitability.

FAQs About Risk-Reward Ratio

1. Can I trade profitably with 1:1 RRR?

Yes, but you need a very high win rate (above 50%) and low costs.

2. Should I always aim for 3:1?

Not necessarily. It depends on your trading style and accuracy.

3. How does RRR affect account growth?

It defines how much you need to win to grow. Higher RRRs mean faster account growth with fewer wins.

Conclusion and Action Steps

-

✅ Calculate RRR before every trade

-

✅ Never enter if RRR is below your threshold

-

✅ Backtest and optimize RRR with past trades

-

✅ Let your winners run and cut losers quickly

Protecting capital is the first goal—profit comes second.

📘 Master Your Risk Mindset with “The Trader’s Reflection”

Knowing your risk-reward ratio is step one—handling the emotions that come with it is step two. The Trader’s Reflection shows you how to think clearly, act calmly, and stay consistent, no matter what the market throws at you.

➡️ Get your copy of The Trader’s Reflection and master the psychology of risk, reward, and resilience.