Forex Trading for Beginners: 12 Steps to Start Currency Trading Confidently

Jeffery ObiagwuShare

What is Forex?

Forex, short for “foreign exchange,” is the world’s largest financial market. It involves trading currencies in pairs—like USD/EUR—to profit from price fluctuations. It operates 24 hours a day, five days a week, making it one of the most accessible markets globally.

Why Trade Currencies?

- High liquidity

- Leverage and low capital requirements

- Diverse trading hours

- Opportunities in both rising and falling markets

How the Forex Market Works

Currency Pairs Explained

Currencies are traded in pairs. For example, in the EUR/USD pair, the euro is the base currency and the U.S. dollar is the quote currency.

Major, Minor, and Exotic Pairs

- Majors: Include USD (e.g., EUR/USD, USD/JPY)

- Minors: Pairs excluding USD (e.g., EUR/GBP)

- Exotics: One major and one emerging currency (e.g., USD/TRY)

Understanding Leverage and Margin

How Leverage Amplifies Risk

Leverage allows you to control larger positions with smaller capital. A 50:1 leverage means you can control $5,000 with just $100.

Margin Requirements

Brokers require a portion of the total trade value as collateral. Be cautious—high leverage increases risk of margin calls.

Step-by-Step Guide to Starting Forex Trading

1. Learn the Basics of Forex

Understand currency pairs, how orders work, and what moves the market.

2. Choose a Trusted Broker

Ensure the broker is regulated (e.g., by FCA, ASIC, or NFA). Compare spreads, fees, and leverage offerings.

3. Open and Fund Your Account

Most brokers offer various funding methods. Start with what you can afford to lose.

4. Understand Currency Pairs

Focus on one or two major pairs first. They’re more stable and have lower spreads.

5. Pick a Trading Platform

MetaTrader 4 or 5 are industry standards. Choose one that suits your technical comfort.

6. Study the Charts and Indicators

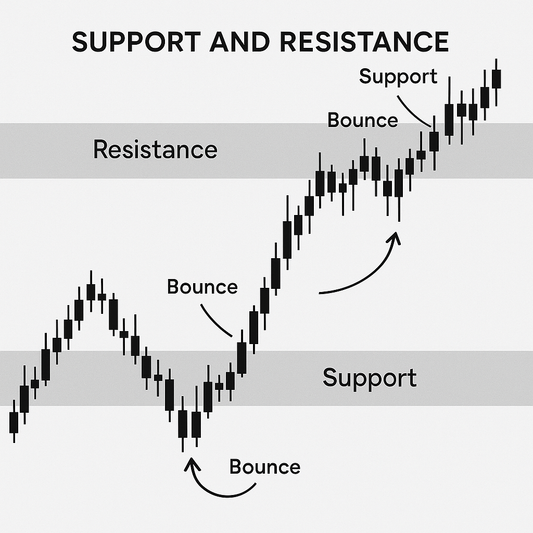

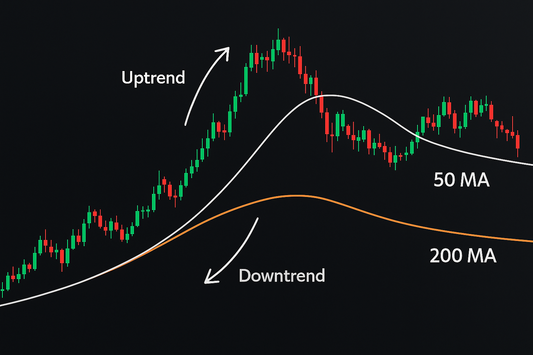

Use moving averages, RSI, and MACD to understand price movements.

7. Practice on a Demo Account

Risk-free environment to test strategies and get used to the platform.

8. Create a Trading Plan

Outline entry and exit rules, risk per trade, and your daily loss limit.

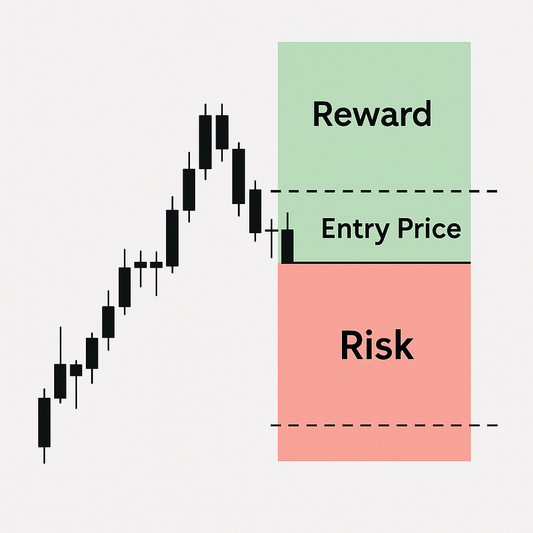

9. Set Risk Limits and Use Stop Losses

Never risk more than 1-2% of your account per trade.

10. Follow Economic News and Calendars

Stay informed on interest rates, inflation data, and geopolitical events.

11. Start with a Simple Strategy

Try trend-following or breakout trading strategies first.

12. Track, Analyze, and Adjust

Keep a journal to review past trades and refine your strategy.

Popular Forex Trading Strategies

- Scalping: Quick trades for small profits.

- Swing Trading: Holding trades for days based on short-term trends.

- Trend Following: Riding the wave of a strong directional move.

Tools Every Forex Trader Needs

- Economic Calendar: Track key data releases.

- Technical Indicators: Tools like Bollinger Bands or Fibonacci retracements.

- Position Size Calculator: Helps manage your risk per trade.

Risks and Challenges in Forex Trading

- High Volatility: Sudden price spikes can wipe out accounts.

- Overtrading: Leads to poor decisions and losses.

- Emotional Decisions: Greed and fear are trading enemies.

Common Forex Trading Terms

- Pip: Smallest price change in the market.

- Lot: The standard trade size.

- Spread: Difference between buy and sell price.

- Stop Loss/Take Profit: Automated orders to manage risk and lock profits.

The Best Times to Trade Forex

- Best Sessions: London and New York overlap (8 AM – 12 PM EST).

- Avoid: Weekends and low liquidity hours.

Beginner Mistakes to Avoid

- Ignoring Risk Management: One bad trade can ruin an account.

- Trading Without a Plan: Leads to inconsistent results.

- Chasing the Market: Reacting emotionally to trends.

FAQs on Forex Trading

1. Is forex trading legal?

Yes, but ensure your broker is regulated in your country.

2. Can I trade forex part-time?

Yes. Many retail traders trade in the evenings or early mornings.

3. How much can I make as a beginner?

It varies. Focus on learning and consistency rather than fast profits.

Conclusion and Final Thoughts

Forex trading is accessible, exciting, and potentially rewarding—but it’s not a get-rich-quick scheme. Focus on mastering the basics, sticking to your trading plan, and maintaining strict discipline. With practice, patience, and continuous learning, success is within reach.