Swing Trading for Beginners: 17 Powerful Strategies to Maximize Profits

Jeffery ObiagwuShare

Introduction to Swing Trading

What is Swing Trading?

Swing trading is a short- to medium-term trading strategy where traders hold assets for several days to a few weeks. Unlike day trading, which involves buying and selling within a single trading day, swing trading aims to capture larger price movements over a longer period.

History and Evolution of Swing Trading

Swing trading dates back to the early 20th century but gained mainstream popularity with the rise of charting tools and online trading platforms in the 1990s. Today, it is a favored strategy among part-time traders looking to capitalize on market swings without the stress of minute-by-minute monitoring.

How Swing Trading Works

Market Mechanics Explained

Swing traders operate within the sweet spot of market volatility—buying when prices are poised to rise and selling before momentum fades. They use technical and fundamental tools to identify price patterns and entry/exit points.

Holding Periods and Trade Duration

Most swing trades last from a few days to a couple of weeks. This duration allows traders to take advantage of short-term trends while avoiding overnight risks typical in day trading.

Swing Trading vs. Other Strategies

Swing Trading vs. Day Trading

- Swing Trading: Fewer trades, longer holding periods, less screen time.

- Day Trading: Multiple trades daily, requires full-time attention.

Swing Trading vs. Long-Term Investing

- Swing Trading: Focus on short-term price movements.

- Investing: Based on long-term growth potential and fundamentals.

Tools Needed to Start Swing Trading

Trading Platforms

Select platforms with low fees, fast execution, and robust charting tools like Thinkorswim, TradingView, or MetaTrader.

Charting Software

Charting software helps identify patterns, support/resistance levels, and indicators essential for swing trades.

Reliable Internet & Broker Selection

A stable internet connection is crucial. Choose a regulated broker offering competitive spreads and responsive support.

Key Concepts Every Beginner Should Know

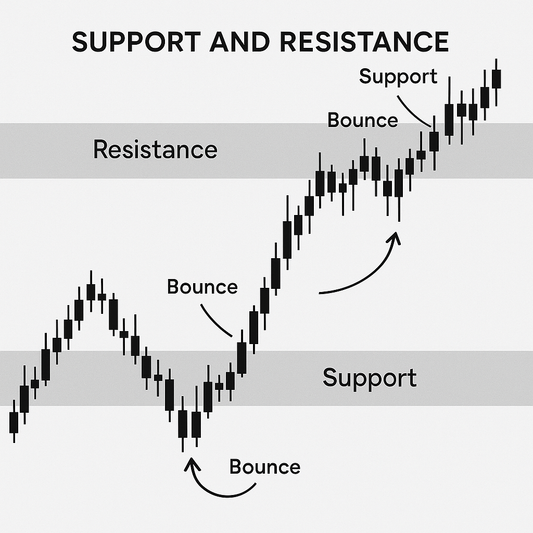

Support and Resistance

These are price levels where buying or selling pressure often causes reversals. Identifying these levels helps in timing entries and exits.

Trend Lines and Channels

Trend lines connect highs or lows in a chart, while channels combine two trend lines to visualize the price path.

Volume Analysis

Rising volume during price moves confirms strength, while falling volume can signal a weakening trend.

Technical Indicators for Swing Trading

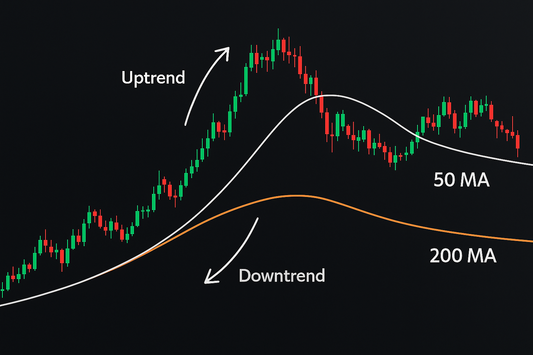

Moving Averages (MA)

MAs smooth out price data. Common types include the 50-day and 200-day MA, useful for trend confirmation.

Relative Strength Index (RSI)

RSI measures momentum on a 0–100 scale. Readings above 70 indicate overbought, below 30 oversold.

MACD and Stochastic Oscillators

These indicators help spot trend reversals and signal entry/exit points based on momentum changes.

Fundamental Analysis in Swing Trading

Earnings Reports and News Events

Company performance reports often trigger price swings. Traders use this data to anticipate moves.

Economic Calendars

Economic releases like GDP, employment data, and interest rates can influence market sentiment.

Sector Trends

Knowing which sectors are outperforming helps in identifying strong stocks to trade within those sectors.

Psychology of Swing Trading

Controlling Emotions

Fear and greed can lead to premature exits or risky trades. A disciplined mindset is crucial.

Avoiding Overtrading

More trades don’t mean more profit. Focus on high-probability setups.

The Importance of Patience

Successful swing trading requires waiting for the right conditions—not forcing trades.

Developing a Swing Trading Strategy

Setting Entry and Exit Points

Define clear rules for buying and selling based on indicators or patterns.

Position Sizing

Determine how much capital to risk per trade, usually 1-2% of total equity.

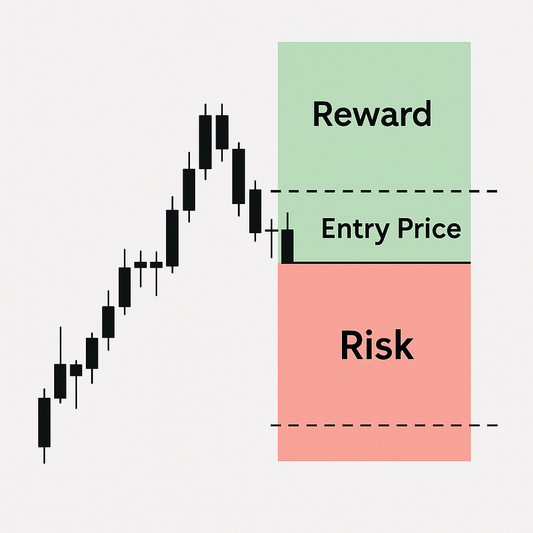

Risk-Reward Ratio

A good ratio is 2:1 or higher, meaning potential profit is twice the risk taken.

Swing Trading in Bull vs. Bear Markets

Adapting Strategies in Volatile Times

In bull markets, traders focus on buying pullbacks. In bear markets, they may short rallies or stay in cash.

Identifying Market Sentiment

Use indicators like the VIX or sentiment surveys to gauge whether markets are optimistic or fearful.

Risk Management in Swing Trading

Stop-Loss and Take-Profit Techniques

Always set a stop-loss to limit downside and a take-profit to lock in gains.

Diversification Tactics

Trade across sectors and asset types to reduce risk concentration.

How to Find the Right Stocks for Swing Trading

Screening Tools

Platforms like Finviz or MarketSmith help filter stocks based on criteria like volume, volatility, and technical setups.

Volatility and Liquidity Metrics

Choose stocks with consistent volume and sufficient price movement for trade opportunities.

Common Mistakes Beginners Make

Chasing Trades

Jumping into a trade after the move has started often leads to losses.

Ignoring the Bigger Picture

Focus only on charts and neglecting fundamentals can backfire.

Lack of a Trading Plan

Without a plan, emotions take over, leading to inconsistent results.

Case Studies of Successful Swing Trades

Real-Life Trade Examples

- Example 1: Buying Tesla on a breakout pattern.

- Example 2: Shorting a biotech stock post-earnings miss.

Lessons Learned and Key Takeaways

Patience, discipline, and adherence to strategy were the common traits in these winning trades.

Best Books and Courses for Learning Swing Trading

Top Recommended Reads

- “Swing Trading for Dummies” by Omar Bassal

- “Technical Analysis Explained” by Martin Pring

Online Resources and Platforms

Websites like Investopedia, Babypips, and Coursera offer beginner-friendly swing trading education.

FAQs About Swing Trading

1. What capital do I need to start swing trading?

You can start with as little as $1,000, but $5,000–$10,000 offers better flexibility and diversification.

2. How much time is required daily?

Most swing traders spend 30–60 minutes per day analyzing trades.

3. Can I swing trade part-time?

Absolutely. It’s ideal for those with full-time jobs.

4. Do I need special software?

Basic charting tools and a trading platform are sufficient to start.

5. Is swing trading risky?

All trading involves risk, but with proper risk management, swing trading can be relatively safe.

6. What is the success rate of swing traders?

With education and discipline, many traders become profitable within 6–12 months.

Conclusion and Next Steps

Swing trading is an exciting path for beginners aiming to profit from market movements without full-time commitment. By mastering technical tools, managing risk wisely, and cultivating patience, you can steadily grow your trading confidence and capital.

Ready to dive in? Start with a demo account, track your performance, and build a strategy tailored to your lifestyle and risk tolerance.