Introduction to Trading Psychology

Why Mindset Matters in Trading

In trading, your greatest asset isn’t your strategy—it’s your state of mind. Even with a proven trading system, emotional reactions like fear, greed, or frustration can sabotage your success. The most consistent traders aren’t just technically skilled—they’re mentally prepared.

Emotions vs. Logic

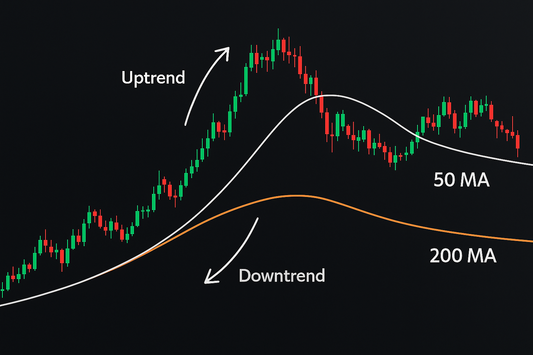

Traders face a constant battle between emotional impulse and rational analysis. A disciplined mind helps you follow your plan even when the market gets turbulent.

Core Psychological Principles in Trading

- Discipline: Consistently following your rules.

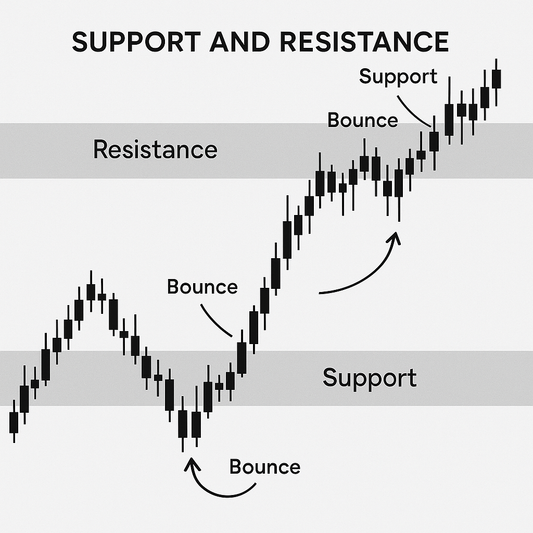

- Patience: Waiting for quality setups, not forcing trades.

- Confidence: Trusting your process without arrogance.

Mastering these core principles separates amateurs from professionals.

Common Emotional Traps

Fear of Missing Out (FOMO)

Chasing trades because others are profiting leads to impulsive decisions.

Greed

Holding trades too long or overleveraging because of “what ifs” can turn winners into losers.

Revenge Trading

Trying to recover losses immediately often deepens the damage.

Analysis Paralysis

Overanalyzing data can prevent you from pulling the trigger on good trades.

How Emotions Affect Decision Making

- Fight-or-Flight Response: High-stress markets trigger survival instincts that impair judgment.

- Impulsive Behavior: Skipping analysis to act quickly usually results in losses.

- Emotional Exhaustion: Trading fatigue leads to poor concentration and rash decisions.

The Role of Discipline in Trading

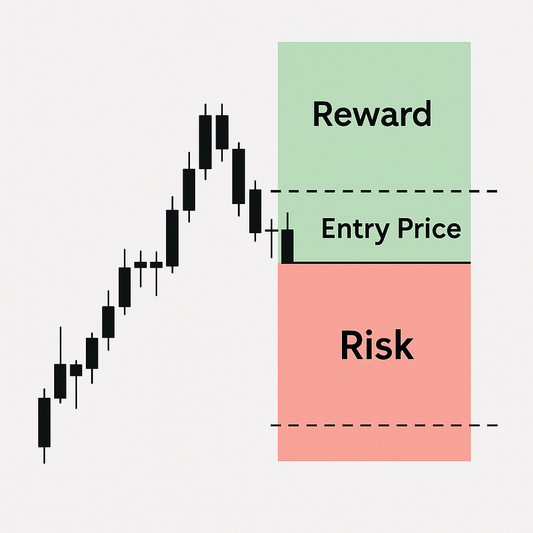

Discipline isn’t just about following rules—it’s about protecting yourself from your worst impulses.

- Stick to your plan.

- Honor stop-losses without hesitation.

- Limit the number of trades to avoid burnout.

Building a Winning Trading Mindset

- Positive Self-Talk: Reframe losses as learning opportunities.

- Managing Expectations: Avoid unrealistic profit goals.

- Resilience and Adaptability: Bounce back after setbacks with a clear plan.

Habits of Emotionally Intelligent Traders

- Journaling and Reflection: Documenting emotions reveals destructive patterns.

- Recognizing Bias: Spotting confirmation bias helps in staying objective.

- Staying Objective: Focus on facts, not feelings.

Visualization and Mental Rehearsal

Imagine yourself executing a trade with clarity and control. Athletes use this—traders can too.

- Picture ideal trade scenarios.

- Rehearse reacting calmly to surprises.

Managing Stress and Burnout

- Signs: Irritability, fatigue, overtrading.

- Solutions: Take breaks, sleep well, meditate.

- Mindfulness Techniques: Breathing exercises, meditation, and gratitude help regulate your emotional state.

Using a Trading Journal for Mental Clarity

- What to Log: Entry/exit, setup, emotional state, outcome.

- Review Weekly: Identify emotional triggers and successes.

- Track Progress: Use journal entries to refine your mental game.

Learning from Losses and Mistakes

- Turn Pain into Progress: Review losing trades without blame.

- Detach Self-Worth: A loss isn’t a failure—it’s data.

Importance of Routine and Structure

- Pre-Market Prep: Review news, check setups, breathe.

- Post-Market Review: Analyze trades, update your journal.

- Daily Checklist: Keeps your mind focused and reduces decision fatigue.

How Confidence Differs from Overconfidence

- Confidence: Based on preparation and analysis.

- Overconfidence: Leads to reckless trades and ignoring red flags.

- Stay grounded, especially during winning streaks.

FAQs on Trading Psychology

1. How do I stop emotional trading?

Stick to your trading plan. Use stop-loss orders. Take regular breaks to clear your mind.

2. Can psychology really improve results?

Absolutely. Most traders fail not because of strategy but due to poor emotional control.

3. What are good mindset habits for traders?

Journaling, mindfulness, visualization, and disciplined routines.

Conclusion and Next Steps

Mastering your mind is the ultimate trading edge. Tools and strategies matter, but mindset determines consistency. Build a mental framework. Train your mind like a muscle. Because when you master yourself—you master the market.