Volume Analysis in Trading: How to Read and Use Volume for Better Entries

Jeffery ObiagwuShare

Introduction to Volume in Trading

What Is Trading Volume?

Trading volume refers to the number of shares, contracts, or lots exchanged over a period of time. It’s a vital measure of market activity and investor participation.

Why Volume Matters

Volume is often called the “pulse” of the market. It confirms the strength behind price movements. A price move backed by high volume is more trustworthy than one with low volume.

How Volume Reflects Market Activity

Buying vs. Selling Pressure

-

High volume on green candles: Suggests strong buying interest.

-

High volume on red candles: Indicates heavy selling.

Understanding this dynamic helps you spot who’s in control—buyers or sellers.

Volume as a Confirmation Tool

Volume validates:

-

Breakouts

-

Reversals

-

Trends

No volume = no commitment. Price may reverse without volume support.

Volume Basics Every Trader Must Know

Relative Volume (RVOL)

Shows how current volume compares to the average. A high RVOL signals unusual interest, often ahead of big moves.

Volume Bars and Indicators

Most platforms display volume as vertical bars beneath the price chart. Taller bars = higher activity.

Popular Volume-Based Indicators

Volume Moving Average

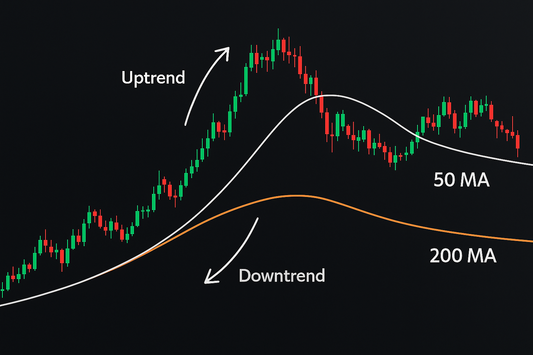

Smoothed version of raw volume to spot trends.

On-Balance Volume (OBV)

Measures cumulative buying/selling pressure. Rising OBV confirms uptrend.

Volume Oscillator

Shows difference between two volume moving averages to reveal shifts in activity.

Volume and Price Relationship Explained

Volume with Breakouts

A breakout with increased volume = confirmation

A breakout with low volume = risk of fakeout

Volume During Consolidation

Decreasing volume in a range can signal an impending breakout.

Divergence Between Price and Volume

If price makes new highs on declining volume, the move may lack strength and reverse soon.

High Volume vs. Low Volume Trades

When High Volume Confirms Strength

-

Confirms breakout and continuation

-

Signals institutional interest

Why Low Volume Signals Caution

-

Low conviction

-

Higher likelihood of false moves

Volume Spikes: What They Really Mean

Institutional Activity

Sudden volume surges often indicate large players entering or exiting positions.

News-Driven Moves

Volume often spikes during earnings, economic data releases, or breaking news.

Trap Setups

Some spikes are designed to lure retail traders before reversing—a classic bull/bear trap.

Using Volume for Better Entry Timing

Confirming Breakouts

Look for a volume surge on the breakout candle.

Spotting Fakeouts

Breakouts on weak volume often reverse quickly.

Entry During Volume Pullbacks

When price dips and volume fades, a low-volume pullback in an uptrend can signal a re-entry opportunity.

Combining Volume with Chart Patterns

Volume in Head & Shoulders

-

Volume drops with each shoulder.

-

Confirms breakdown with spike on the neckline break.

Volume in Triangles and Flags

-

Triangle breakout needs a volume burst.

-

Flags typically see low volume during consolidation, then a spike on breakout.

Volume Strategy for Beginners

Step-by-Step Guide:

-

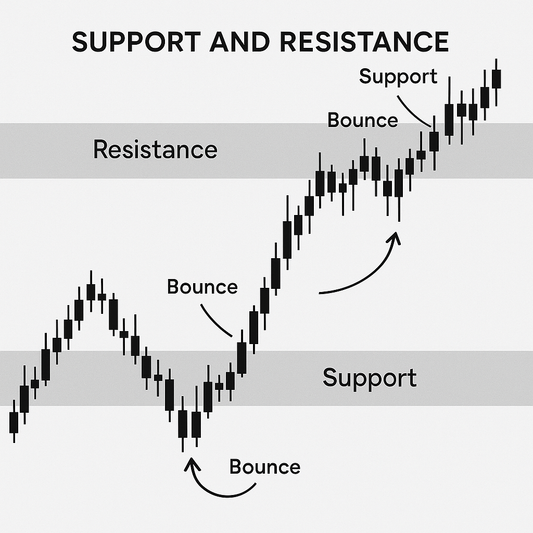

Identify support/resistance.

-

Watch volume near key levels.

-

Confirm breakout or rejection with volume.

-

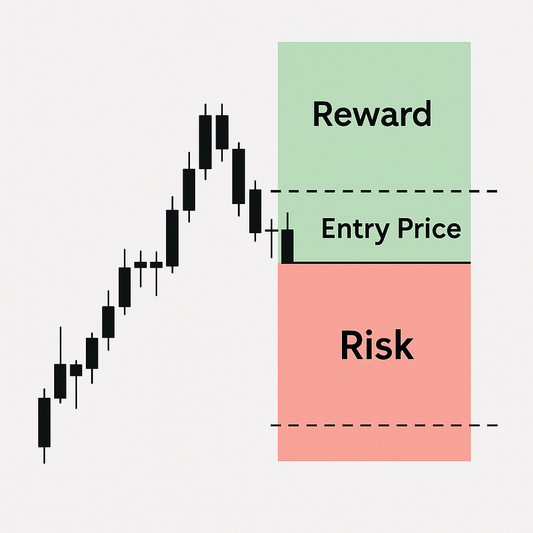

Enter with clear stop-loss and risk-reward.

-

Log result and reflect.

Volume Checklist Before Every Trade

-

Is volume increasing with price?

-

Is the move supported by RVOL or OBV?

-

Are there prior volume patterns at similar levels?

Common Mistakes in Volume Analysis

-

Misinterpreting Spikes: Not all spikes signal breakouts.

-

Relying Solely on Volume: Always combine with price action.

-

Ignoring Context: Volume during lunchtime ≠ volume during market open.

Tools and Platforms for Volume Analysis

-

TradingView: Custom volume scripts and indicators.

-

Thinkorswim: Deep volume studies.

-

MetaTrader 5: Good for Forex volume proxies.

FAQs About Volume in Trading

1. Can volume predict price?

Not directly. Volume confirms or contradicts price action.

2. How do you confirm volume strength?

Compare it to the average (RVOL) or look for unusual surges.

3. Is volume analysis enough to trade?

No. Use it with chart patterns, trends, and risk management for best results.

Conclusion and Actionable Tips

Volume is a powerful tool when used right. Don’t trade on price action alone—make volume your confirmation companion. Whether you're identifying breakouts, validating trends, or spotting traps, mastering volume will sharpen your entries and improve your results.

📘 Take Your Mindset Further with “The Trader’s Reflection”

If you found this guide helpful, you’ll love The Trader’s Reflection—your ultimate companion to mastering trading psychology, discipline, and emotional control. Packed with real insights and actionable exercises, it’s the perfect addition to your volume strategy.

➡️ Get your copy of The Trader’s Reflection today and start trading with clarity and confidence.