Why Most Traders Fail (And How You Can Succeed)

Jeffery ObiagwuShare

Trading seems like a dream job—freedom, fast money, and flashy wins. But here’s the truth: most traders lose money. Not because markets are evil, but because they don’t have the right tools, mindset, or strategy.

Let’s break down the cold, hard facts—and show you how to flip the script.

1. The Harsh Reality: 90% of Traders Lose

Statistically, over 90% of traders fail in their first year.

Why? Because trading is deceptively simple but brutally unforgiving.

Common Early Mistakes:

-

Chasing "hot tips"

-

Over-leveraging

-

Lack of a consistent trading plan

-

Emotional decisions

2. Why Psychology is the Real Battlefield

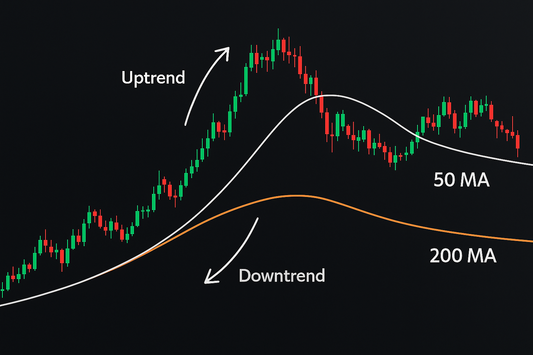

Technical analysis? Important. Market news? Useful.

But nothing derails a trader faster than their own brain.

Fear and greed are powerful drivers. They:

-

Push you to sell too early

-

Keep you in losing trades too long

-

Trigger revenge trades

➡️ This is where The Trader's Reflection shines. It goes deep into trading psychology and offers daily mindset tools for staying sharp and calm.

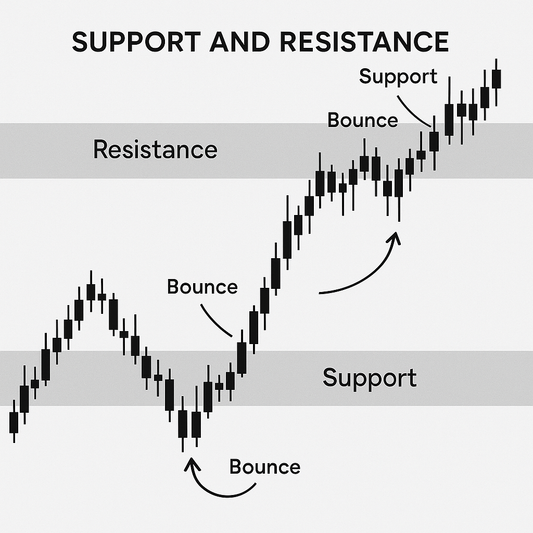

3. You Need a Process—Not Just a Plan

A trading plan is your strategy.

A trading process is your discipline.

To succeed, you must:

-

Stick to pre-defined entry/exit rules

-

Review trades weekly

-

Log emotions as well as numbers

✅ Tip: Start a "Trader's Journal" (yes, paper still works wonders).

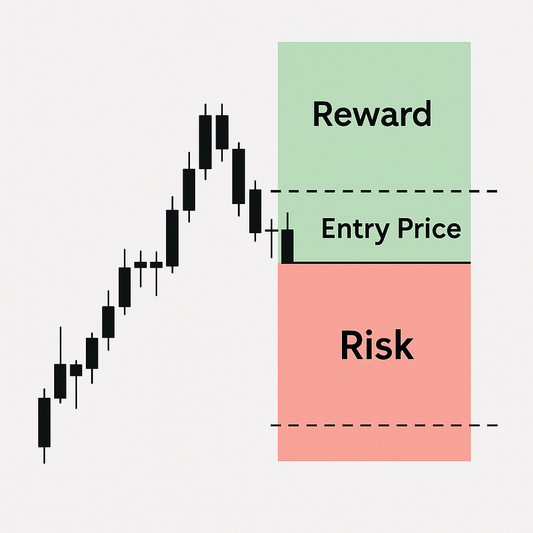

4. The Power of Risk Management

Want to stay in the game long enough to learn it?

Then protect your capital like it’s gold.

Risk Rules to Live By:

-

Never risk more than 1-2% per trade

-

Always use stop-losses

-

Diversify—don’t marry one trade

Even top traders win only 50-60% of the time. Survival is key.

5. Education ≠ Watching YouTube All Day

True trading education involves:

-

Studying price action, not predictions

-

Learning from your data

-

Reading real trader insights (not hype)

📚 Recommended Read: The Trader's Reflection—designed to help traders build mental clarity, emotional strength, and performance consistency.

FAQs: Real Questions from Aspiring Traders

Q1: How much money do I need to start trading?

Start with what you can afford to lose. $500–$1,000 is enough for beginners to learn.

Q2: How long until I become profitable?

Expect 6–12 months of learning. Consistency beats speed.

Q3: What’s better—day trading or swing trading?

Depends on your schedule. Day trading is time-intensive; swing trading offers flexibility.

Q4: Should I quit my job to trade full-time?

Not until you’re consistently profitable for 12+ months.

Q5: Can a mindset book really help with trading?

Absolutely. The Trader's Reflection isn’t fluff—it’s the mirror every trader needs.

Q6: How do I handle a big trading loss?

Step back. Review what went wrong. Journal it. Then reset and come back stronger.

How The Trader’s Reflection Can Help You Win

Unlike other trading books that focus on charts and strategies, this one digs deeper.

What you’ll gain:

-

Mental frameworks for high-stress decision-making

-

Real journaling prompts used by pros

-

A system for reflection, correction, and improvement

🛒 Ready to trade smarter, not harder?

Grab your copy of The Trader’s Reflection today and start your transformation.

Final Thoughts

Trading success isn’t just about skill. It’s about staying in the game long enough to learn, grow, and master your edge. Most fail not because they’re dumb—but because they’re unprepared.

You can be different. Start with awareness. Build a system. Master your emotions.

And above all—reflect often.