Day Trading for Beginners: 15 Rules Every New Trader Must Know

Jeffery ObiagwuShare

What is Day Trading?

Day trading is the practice of buying and selling financial instruments—like stocks, forex, or crypto—within the same trading day. The goal is to profit from small price movements using short-term strategies.

Benefits and Challenges

Benefits:

- Potential for quick profits

- No overnight market exposure

- High-frequency trading opportunities

Challenges:

- High stress and screen time

- Requires quick decision-making

- Risk of significant losses

Essential Tools for Day Trading

Trading Platforms

Reliable platforms like Thinkorswim, MetaTrader, or TradingView provide the real-time data and order execution tools necessary for success.

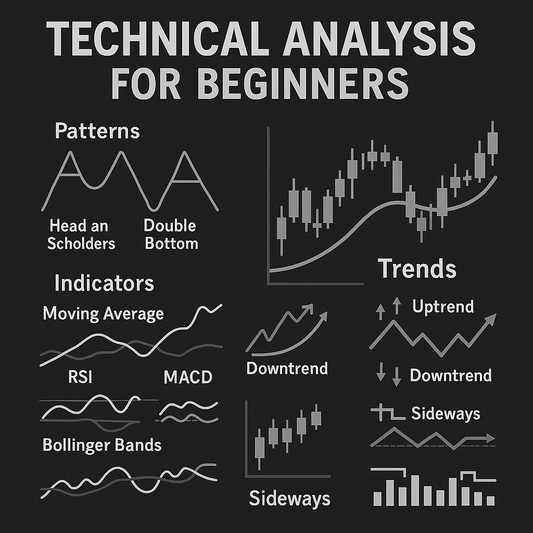

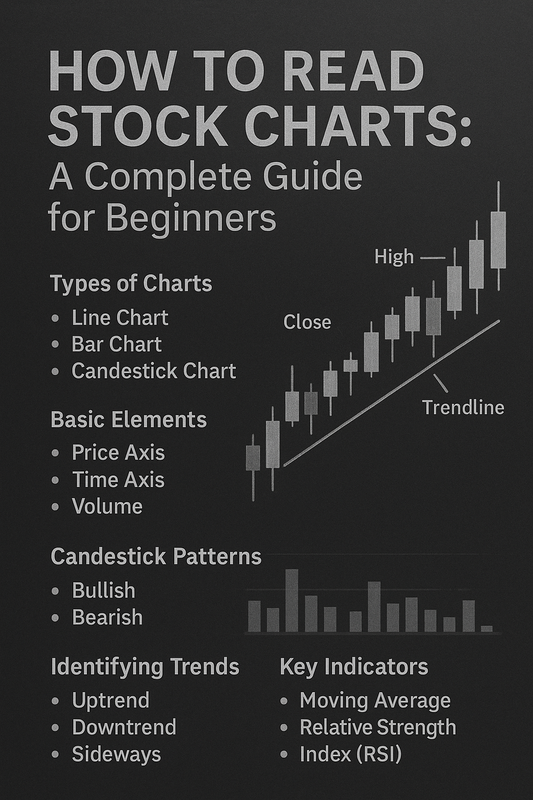

Charting Software

Day traders rely heavily on charts to analyze trends and spot opportunities. Tools must include multiple time frames, indicators, and drawing features.

High-Speed Internet

Fast, stable internet is non-negotiable. Delays in order execution can turn a winning trade into a loss.

Market Types to Trade In

Stocks

Offers high liquidity and predictable behavior but requires more capital due to PDT (Pattern Day Trader) rules.

Forex

Open 24/5, forex is ideal for global traders with tight spreads and high leverage.

Cryptocurrency

Volatile and open 24/7, crypto markets offer opportunities but with high risk.

Futures

Traded in contracts, futures offer leverage and tax advantages but are more complex.

Basic Terminology Explained

- Bid/Ask: The highest price buyers will pay (bid) vs. the lowest price sellers will accept (ask).

- Spread: The difference between bid and ask—lower is better for day traders.

- Volume: Number of shares/contracts traded—higher volume often means more opportunities.

- Leverage: Trading with borrowed funds; increases risk and reward.

15 Day Trading Rules for Beginners

- Start with a Demo Account: Practice risk-free to learn how markets and platforms work.

- Set a Daily Loss Limit: Protect capital by knowing when to stop.

- Trade a Fixed Amount: Avoid risking more than 1–2% of your account on a single trade.

- Stick to One Strategy at a Time: Master it before moving to others.

- Avoid Trading on News: Markets react unpredictably during news releases.

- Respect Your Stop-Loss: Set it and don’t move it once a trade is live.

- Avoid Overtrading: More trades don’t mean more profit.

- Don’t Trade with Emotions: Fear and greed are your worst enemies.

- Keep a Trading Journal: Record trades to review and improve.

- Use Risk-Reward Ratios: Aim for at least 2:1 profit-to-risk ratios.

- Focus on Liquid Assets: Trade stocks and assets with high volume and tight spreads.

- Know When Not to Trade: Sitting on your hands is a valid strategy.

- Master One Market: Don’t spread yourself thin—focus builds expertise.

- Limit Screen Time: Over watching can lead to fatigue and bad decisions.

- Review and Adapt Your Strategy: Market conditions change—so should you.

Risk Management Techniques

Always trade with a clear plan:

- Use stop-loss orders to limit potential losses.

- Set realistic take-profit levels.

- Diversify trade setups to spread risk.

Best Times to Trade

- Stock Market: First two hours after open and the last hour before close.

- Forex: London/New York overlap is ideal.

- Crypto: High volume during global news or tech adoption spikes.

Avoid mid-day lulls or holiday trading unless necessary.

Common Mistakes to Avoid

- Revenge Trading: Trying to “win back” losses usually leads to bigger ones.

- Ignoring Trends: Fight the trend, and you’ll lose more often than win.

- Copying Others Blindly: Strategies that work for one trader may not suit your style.

Day Trading Psychology

Successful day traders are calm under pressure and disciplined:

- Take breaks regularly.

- Meditate or exercise to clear your mind.

- Know when you’re not in the right mindset to trade.

Top Day Trading Strategies

- Scalping: Quick in-and-out trades capturing small price moves.

- Breakout Trading: Trading when price breaks above/below key levels.

- Trend Following: Ride the wave using indicators like moving averages.

FAQs on Day Trading

1. How much money do I need to start day trading?

At least $25,000 for U.S. stocks to avoid PDT rules; less for forex and crypto.

2. Can I day trade part-time?

Yes, especially in forex and crypto due to flexible hours.

3. What’s a good win rate?

50–60% with solid risk-reward ratios can be very profitable.

4. Is day trading legal?

Absolutely, but brokers and tax regulations apply.

5. Do I need a license?

Not unless you manage others’ money professionally.

Conclusion and Final Tips

Day trading is rewarding but requires preparation, discipline, and emotional control. Start slow, master one strategy, and grow with experience. Never stop learning and stay grounded—because in trading, patience is more profitable than speed.